An emergency fund is your financial safety net, your buffer against unforeseen expenses like a medical emergency, sudden car repairs, or job loss. But building an emergency fund can seem like an insurmountable goal, especially when you’re living on a tight budget. The good news? It’s entirely achievable—with the right strategy.

Whether you’re resolving existing debt with experts like The Oakman Group or you’re just starting your financial planning journey, this guide walks you through practical, step-by-step solutions to build an emergency fund even when your budget is stretched thin.

Why Do You Need an Emergency Fund?

An emergency fund is not a luxury; it’s a necessity. It is what shields you from dipping into high-interest credit or falling into debt when life throws unexpected curveballs. Here are some compelling reasons to prioritize it:

- Financial Security: Achieving a sense of security can reduce stress and allow you to focus on long-term financial goals.

- Debt Prevention: Avoid piling on credit card debt when the unexpected arises.

- Peace of Mind: Knowing you have a financial cushion lets you sleep better at night.

Even if you’re resolving financial difficulties with experts like oakmangroup.com, starting to build a modest emergency fund can be your first step toward financial independence.

6 Steps to Build an Emergency Fund on a Tight Budget

1. Evaluate Your Current Budget

Start by taking an honest look at where your money is going.

- List your monthly income.

- Categorize your expenses into fixed (rent, utilities) and variable (groceries, entertainment).

- Identify areas where you can cut costs.

Even saving $5 a week from small lifestyle adjustments—like brewing your coffee at home instead of buying it—can go directly into your emergency fund.

2. Start Small but Start Now

Many people hesitate to start saving because they feel their contribution is too small. But even saving $10 or $20 a week adds up over time. Here’s how those savings compound:

- $20 per week = $1,040 in a year.

- $5 per day = $1,825 in a year.

Set attainable goals, such as building your first $500. This small fund can already cover minor emergencies like car repairs.

3. Automate Your Savings

One of the easiest ways to grow an emergency fund is to set it and forget it.

- Open a separate savings account specifically for your fund.

- Use automated transfers from your checking account after each paycheck.

Even transferring just 2% to 5% of your income per month can make a meaningful difference without denting your daily budget.

4. Cut Variable Costs Strategically

If you’re feeling overwhelmed, start by reducing discretionary spending. Here are some quick wins:

- Cancel unused subscriptions (apps, streaming services).

- Cook at home more often instead of dining out.

- Shop smarter by buying generic brands or during sales.

Redirect these savings to your emergency fund—they’ll add up faster than you expect.

5. Use Windfalls Wisely

Did you receive a tax refund, a work bonus, or a birthday gift? Resist the urge to spend it all and consider putting at least 50-70% into your emergency fund. Windfalls, no matter how small, can push you closer to your savings goal and relieve the stress of monthly paycheck dependency.

6. Supplement Your Income

If your budget is already tight, finding ways to increase income can speed up the process.

- Side Hustles: Consider freelancing, tutoring, or selling unused items online.

- Gig Work: Platforms like Uber, DoorDash, or TaskRabbit can help you make extra cash on the weekends.

- Passive Income: Rent out unused items like tools or sporting equipment.

Even an extra $50 per month dedicated to savings can make a significant impact.

How to Stay Motivated

Building an emergency fund takes time, so staying motivated is important.

- Celebrate milestones. When you hit $100, $500, or $1,000 saved, reward yourself with something small (within your budget).

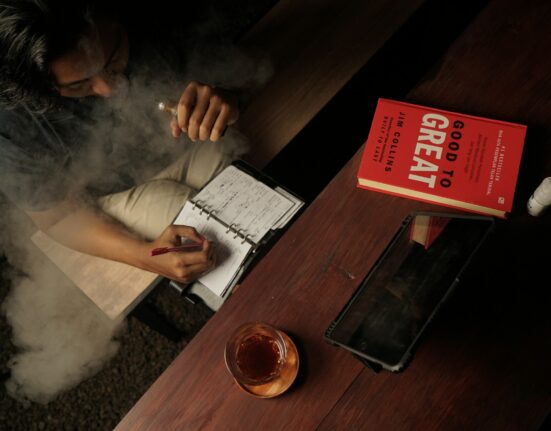

- Visualize your progress. Use a chart, app, or notebook to track your savings growth—it’s incredibly satisfying and keeps you on track.

- Remind yourself of the why. Whether it’s preparing for unexpected expenses or simply achieving peace of mind, focus on what your emergency fund will do for you.

What If You’re Managing Debt?

Balancing debt repayments and savings can feel overwhelming. If you’re dealing with significant debt, seeking expert advice from Licensed Insolvency Trustees like The Oakman Group can help you create a realistic savings plan that includes room for saving. They create tailored solutions that offer relief while setting you up for long-term financial success.

Make It a Habit

The key to building an emergency fund—even on a tight budget—is consistency. Start small, automate where possible, and celebrate your progress.

Over time, these small efforts will compound, building not only your savings but also your confidence and financial stability. To reach that next level, explore additional financial strategies tailored to your needs by connecting with experts like oakmangroup.com for personalized guidance.

Leave feedback about this